Boosting Financial Advisory with AI: A Guide for Business Owners🔗

With the rise of AI in wealth management, the financial industry has made many changes. Financial advisors need the tools to make well-informed decisions, and AI technologies excel at processing large volumes of data quickly and accurately. AI adds value to the quality of the advice you can provide clients by pinpointing patterns and trends that traditional methods may not. That’s especially good news for business owners, who can cleave their revenue growth strategy to their financial strategies. In short, AI is changing the economics of wealth management with sharper insights, superior decision-making, and more precise financial approaches. These technologies will only become more advanced and the impact on the financial industry will only increase, making AI the necessary tool for modern wealth management.

Advantages of AI for Business Leaders

AI is a smart way to improve financial advisory services without spending a fortune for business leaders. AI driven solutions help lower operational costs by cutting down on manual data analysis. It helps businesses to use their resources more efficiently.

- One of the big advantages is the ability to get real time insights. AI systems are fast at processing a lot of data and in analyzing it all, giving owners of business comprehensive analyses and accurate predictions. With this, you give them the capacity to make educated choices, make a disengaged activity arranging, and propel themselves past competitors.

- Business leaders can also personalize financial strategies using AI. By using client data, AI tools can suggest suitable investment plans that meet an individual’s goals. The level of customization not only improves client satisfaction but also increases the chance of achieving financial objectives.

- Another is that routine tasks are automated. Data entry, reports generation and compliance checks are all easy for AI. This lets financial advisors spend the time they need to have meaningful relationships with clients, and plan for long term financial goals. Additionally, automation reduces the risk of human error, so that financial advice is both accurate and reliable.

- AI driven technologies also excel at risk management. Another use is that they can take into account multiple risk factors at once, offering a broader overview of possible dangers. It allows business owners to take a more proactive approach and protect their investments and financial stability.

- Moreover, AI improves financial transaction security. Real time fraudulent activities can be detected by machine learning models and suspicious behavior can be flagged. It adds another layer of protection for business leaders.

- Scaling financial advisory services also becomes easier when AI is incorporated into them. With business growing, AI systems can easily scale to handle more data and more complex analysis. Expansion of the client base without affecting the quality of service is made possible by this.

Therefore, AI presents a lot of benefits for business leaders, including cost savings, better decision making, better risk management and better security. With the help of AI, business owners can improve their financial advisory service, and stand out in the market.

Automation in Financial Consulting

Technology is helping to automate financial consulting so it’s more efficient and productive.

- Many of these tasks are taken care of by AI driven tools, such as data entry, generating reports and checks to see that things are in compliance. Not only does this speed up these processes, but it also reduces errors, so that financial advice is accurate and reliable.

- For financial advisors this automation allows more time to be used in strategic planning and client interaction. Advisors get away from such bogged down administrative work and are able to spend more time looking into their customers’ needs and such to strategize what plans to offer them.

- Another advantage of automating things, and keeping data sets as simple as possible, is that we can process them more consistently. Huge quantities of financial data can be sifted through by AI banking tools very quickly, painting them vividly in order, identifying trends and patterns that would be missed by a human eye. As a result, there are more informed decisions made and more strategic investments made.

- One of the key benefits of automation with financial consulting, is the ability to accommodate large work volumes without hurting quality. The more a business grows, the more financial advice and services are needed. This demand can easily be scaled up by AI systems, so that every client gets high quality advice.

- In addition, financial services can be provided at any time of the day with automated systems that work round the clock. This is particularly useful for business owners who don’t have time to manage their finances during regular business hours. They can access the financial insights they need with automated tools.

- Another area where automation excels is in the area of risk management. By combining multiple risk factors, AI can view risks holistically, to give the whole picture of threats. This also helps business owners take proactive intervention to safeguard their investments as well as business stability.

- The security of financial transactions is also improved by automation. Real time detection of unusual activity and flagging of potential fraud gives an extra layer of protection for financial operations.

- Automating financial consulting doesn’t just make it more efficient, it also makes clients happier. Clients are more likely to trust and rely on their financial advisors with faster and more accurate service. It develops better relationships and builds more loyalty for clients.

In general, automation is a game changer for financial consulting. AI driven tools help financial advisors streamline routine tasks, provide deeper data insights, and improve security, all of which helps them deliver better service and better outcomes for their clients. The future is automation, and as technology advances so will the role of automation in our financial consulting; and that role will continue to present more benefits to advisors and their clients.

AI Tools and Technologies in Use

By integrating AI tools and technologies, wealth management is becoming more efficient and safer. The robo advisor is one of the most prominent tools in this sector. Financial planning services are provided by these automated platforms, largely with minimal human involvement, using algorithms. Based on your financial situation and goals, they determine what to do. Not only does this save time, but financial advisory becomes more accessible and affordable.

- Machine learning models are another powerful AI tool. Risk assessment and fraud detection require these models. Machine learning can read through large datasets and look for patterns, and try to flag unusual activities that may be a sign of fraud. It helps boost the security of financial transactions and gives business owners the peace of mind.

- One deliciously exciting technology in the AI toolkit is Natural language processing (NLP). NLP lets a computer understand and interpret human language. For example, NLP can be used in the wealth management space to assist in analysing client communications resulting in insights about client preferences and needs. It gives financial advisors the ability to offer more personalized services, and therefore, happier clients.

- AI powered chatbots are also becoming popular. From answering client queries to giving investment advice, these virtual assistants can do a lot of things. Support is available around the clock, whenever clients need it. For busy professionals who don’t have the time to spend an hour around, this level of convenience is especially helpful.

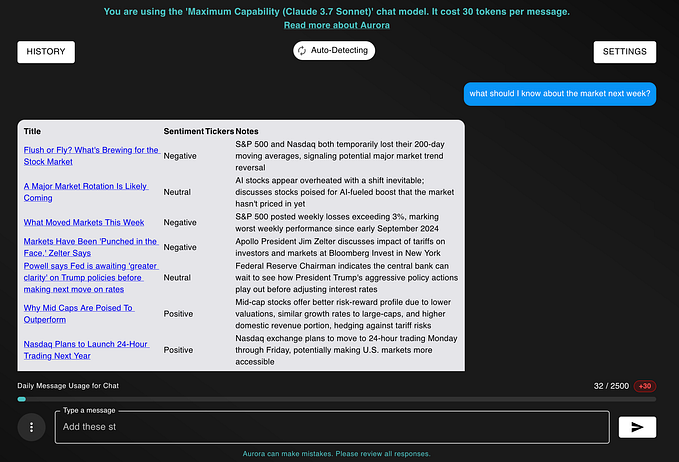

- Another critical component are AI driven analytics platforms. Data sorting tools can make sense of large piles of data to find trends or possibilities. For instance, they can tell whether there are any market conditions that indicate a possible investment opportunity. It allows financial advisors to make well informed decisions quickly, so they can take advantage of market movements.

- Another domain where AI really excels is predictive analytics. Using these tools, historical data allows for future trends to be called with a quite high degree of accuracy. This is incredibly helpful for longer term investment planning, but of course also for risk management. For example, Predictive analytics can insight which assets are likely to go well in the future so advisors can make better investments.

- Compliance and regulatory reporting is also a major role of AI tools. Real time transactions can be monitored by automated systems to make sure they are in line with regulations. The result is that financial institutions aren’t having to worry about non compliance and the penalties that come with it.

- AI is also used in portfolio management. AI algorithms can be used to optimize an asset allocation in order to maximize returns while minimizing risks. And they can also automatically rebalance portfolios so that they continue to align with the investment goals of clients.

In general, AI tools and technologies are radically changing wealth management with better efficiency, security and personalization. Financial advisors are able to provide better services with these innovations, helping business owners reach their financial goals easier.

Challenges and Key Considerations

Benefits of AI in wealth management are numerous, however, there are some challenges that have to be thought over. There is a major issue of data privacy. When you use AI, you need to protect sensitive information. Besides securing the data, it’s also about making sure AI systems register with all applicable regulations.

- An important decision is to select the right software development partner. When it comes to working with a company, it is important to find one that can offer you reliable, secure, and feature rich AI solutions. An AI partner will be trusted to integrate AI smoothly into existing systems and make sure that the software is scalable for future needs.

- There’s also the problem of transparency in AI decision making. Financial advisors and their clients should know how AI algorithms come up with their recommendations. Building trust requires this transparency as it means the advice is actionable and reliable.

- Also, AI systems require continuous maintenance and upgrade. Algorithms have to be adjusted for market conditions to stay effective. In other words, businesses need to spend not only on initial development but also on long term support and upgrades.

- There is another hurdle: training staff to work with AI tools. New technologies and AI generated insights must be comfortable for employees to use and understand. Proper training can go a long way in how well AI is used.

- Finally, businesses should know the cost of implementing AI. In the long run, AI can save you money with improved efficiency and accuracy but there can be a big up front cost. You have to decide to understand what these costs might be, what these benefits are, and then plan accordingly.

Therefore, despite great possibilities that AI brings in the wealth management field, it’s important to consider some issues regarding data privacy, software selection, transparency, maintenance, training, and costs. With the consideration of these facts businesses can maximize the use of the potential of AI.

Real-World Examples and Success Stories

AI has been successfully integrated into many companies’ wealth management processes, and it is a transformative power. For one example, Betterment, a pioneer for robo advisory, has employed AI to manage portfolios.

- By studying the market data, as well as individual client profiles, Betterment’s AI can tailor to a specific investment strategy meeting a specific goal such as improving client satisfaction and engagement.

- A second success story was BlackRock, one of the world’s largest asset management firms. Through their Aladdin platform they have integrated AI into their risk management practices. Market risk assessment and future market movement prediction are done through AI algorithms. Therefore, BlackRock is in a position to give its clients more precise and real investment advice, helping them better transit volatile markets.

- Another example of this is Wealthfront. AI driven financial planning tools are used by them to give personalized advice on investment strategies to retirement planning. Their Path tool uses AI to analyze a client’s financial data and provides tailored recommendations based on real time information. Not only is it more accessible, but it’s also more precise, and financial outcomes for their clients are better.

- As you might imagine, AI has been deployed by Fidelity Investments for boosting customer service. AI powered chatbots are used by them to answer client inquiries effectively. They can answer a wide range of questions, and can do things like update account information or give market updates. By automating this, it frees up human advisors to spend their time on more complex client needs, which in turn leads to better overall service quality.

- Another platform with AI making waves is Schwab Intelligent Portfolios. It provides automated investment advice that adjusts portfolios according to real time market conditions. The AI continually learns and adapts in order to keep the investment strategies on track with its clients’ financial goals. It is a dynamic approach which helps clients to maximize returns with minimum risks.

- AI has also been used in the operations of smaller firms. For instance, Personal Capital is using AI to provide a hybrid robo advisory approach of using humans and automated trading. The AI driven tools give detailed financial analysis that human advisors use to give personalized advice. This combination makes the service better, giving clients the best of both worlds.

AI is not a far away concept; it is something our businesses are already using today to help us provide a better wealth management offering. Such use of AI helps make these companies better able to provide more personalized, efficient, and accurate financial advice, showing just how beneficial technology was to the financial sector.

The Future Landscape of AI in Wealth Management

Looking ahead, the future of AI in wealth management is incredibly bright. And even more developments will make delivering financial advisory services so much better. There is another big development, which is the more sophisticated (faster and more complex) of AI algorithms. These will help give you an even clearer picture of market trends and client behavior and by giving you more customized financial strategies. What would it take to have an AI that can accurately predict market shifts — or point you towards the exact investment opportunity you’ll benefit from more than most, based on your unique risk profile?

- Among other things, Natural language processing (NLP) will continue to grow, making it easier to interact between clients and AI systems. AI powered chatbots could allow clients to have in depth financial discussions with them and get advice that feels personalized and human like. This will allow not only financial planning to become easier for more people, but also will make it accessible at any time and any place.

- Another game changer in the bulls’ sights is blockchain technology. By applying AI on blockchain, financials will be secured and transparent. Not only will this protect sensitive financial data, but will also be effective in allowing processes like compliance checks and fraud detection to run much more smoothly. This allows the business owners to have more confidence in the security of their financial operations.

- Predictive analytics will also be made by AI. Future AI systems will be able to analyze that much more extensive corpus of data points against one another, from economic indicators to social media trends, to forecasts of financial outcomes. By taking this holistic approach, advisors will be better able to develop more robust and forward looking strategies for their clients. What if you could adjust your portfolio in real time based on a wide variety of predictive signals to maximize returns and minimize risk?

- Another trend to watch for is the integration of AI with IoT (Internet of Things) devices. Real time data can be collected by smart devices that AI systems can analyze to give instant financial insights. You could for example have a smart wallet that tracks spending habits and provides personalised budgeting tips, thereby helping clients better manage their finances.

The other area of growth that AI is able to learn or adapt continuously. The quality of financial advice will only get better over time as future AI systems will get even better at self improvement. AI will be able to keep on learning, learn to adapt to new market conditions and new client needs quickly, making sure that the financial strategies remain relevant and effective.

Wrap-Up and Encouragement

To put it simply, AI is changing wealth management for the better of both the financial advisor and their client. AI automates the routine work, allowing advisors to dedicate time to strategization, and client interaction. As such, it finds venture real-time insights and predictive analytics that lead to financial advice that is more accurate and tailored. In particular, business owners can take advantage of AI to improve decision making and to streamline operations.

Robo-advisors and other AI tools such as machine learning models are available to provide a scope of services in the financial planning space from portfolio management to risk assessment. AI driven solutions are not just for large firms, even smaller businesses can reap the benefits of these tools. Business owners get peace of mind by also knowing that the enhanced security features that come with AI also help protect against fraud.

What’s more, AI’s learning capacity on a continuous basis allows the quality of financial advice to get better with each passing day. That being said, as AI algorithms are getting better at data analysis and finding ways to spot trends, their insights become more correct and useful. The ongoing improvement ensures that business owners get the most up to date and effective financial strategies.

Further growth in the AI space will lead to more natural language processing, robust and secure growth in financial advisory services, thanks to blockchain integration. These technologies will not only make financial planning more precise, but also more user friendly, so business owners can easily manage their finances.

It’s not a trend, it’s a smart move for your future success when you incorporate AI into your wealth management strategy. We use AI to help optimize financial advisory services, cut time and resources, and deliver better, more personalized advice to our clients. Therefore, if you want to stay competitive and take advantage of AI, it is time to use AI in wealth management.

Finally, with the future of wealth management bright, AI is in the vanguard of the transformation. With AI driven solutions, you can be sure that your financial advisory services are efficient, secure and tailored to your clients’ needs.